James Portelli is currently a Chairman and Independent Non-Executive Director on a portfolio of insurance undertakings authorized and regulated by the Malta Financial Services Authority to transact business with Europe by virtue of the EU Freedom of Services and Freedom of Establishment directives and also in the UK by virtue of the temporary permissions regime. James has been MFSA (Malta) and FCA (UK) approved for a number of years.

He chairs or has chaired or participates in the Risk Management and Compliance Board Committees of all the regulated entities requiring such a committee.

Board Appointments

2015 to date

Current regulated Board appointments include:

- Chairman, IPP (Malta) Limited (https://www.ippmalta.com/default.asp) | A broker specialising in niche credit-related insurance products specifically for the global travel and holiday/leisure sector.

- Independent Non-Executive Director and Chairman of the Risk Management & Compliance Committee, EUCARE Insurance PCC (https://www.eucareinsurance.com/?lang=en) | EUCARE is a specialist healthcare insurance company.

- Independent Non-Executive Director, Square Trade Europe Limited (https://www.squaretrade.com/), Square Trade is a European insurance intermediary owned by AllState focusing on consumer-products insurance.

- Independent Non-Executive Director, Robus Risks Services (Malta) Limited (https://www.robusgroup.com/) | An insurance management services company active in Guernsey, Gibraltar and Malta. (awaiting regulatory approval)

Non-regulated appointments include:

- President of the Malta Insurance Institute (www.mii.mt) | National insurance institute.

- Member of the Cutts Watson Consulting Team (https://cuttswatson.com/) | Non-regulated, independent captive insurance consulting (https://cuttswatson.com/cwc-expands-in-to-malta/)

- Founder/Senior Advisor, Portelli & Associates (www.portelliassociates.com) | Non-regulated management consulting/training & development

- Visiting lecturer, insurance and risk management at the University of Malta (https://www.um.edu.mt/fema/insurance/aboutus) and visiting trainer and consultant (Bahrain Institute of Banking and Finance), Bahrain. (https://www.bibf.com/)

Previous regulated Board appointments include:

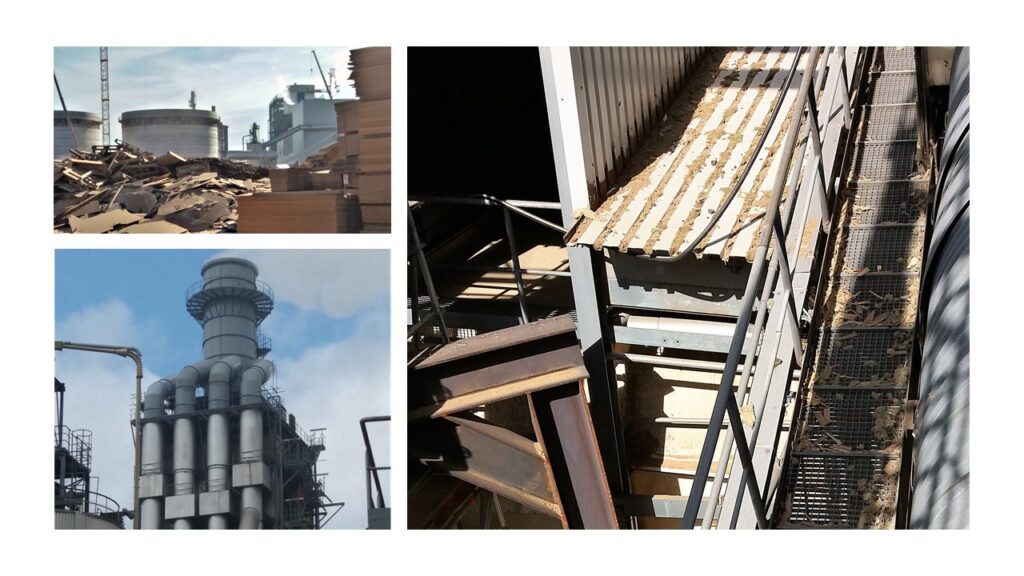

- Managing Director, (2016 – 2020) Board Member and Risk Chair of Hillwood Limited | An MFSA-regulated insurance company acting primarily as a captive insurer for one of the largest global wood-processing enterprises. With Hillwood Ltd, James was also actively involved in risk management reviews of factories across Europe focusing on fire and engineering safety, housekeeping, health and safety and risk management protocols.

- Board Member and Risk Chair of Building Block Insurance PCC (2017 – 2020) (https://www.buildingblockpcc.com/), | An MFSA-regulated insurance company authorized to passport insurance across Europe by virtue of the EU Freedom of Services Directive and into the UK by virtue of the current temporary permissions regime.

- General Manager, Board Member and Board Committee Member, Fortegra Europe Insurance Company Limited (https://www.fortegra.eu/) | An A-rated European subsidiary of a US insurer specializing in auto and non-auto related warranty/extended warranty and consumer insurances.

Senior Executive Management Experience

1990 – 1998

Qualified as an Associate of the Chartered Insurance Institute in 1992 and a Fellow of the Risk Management Institute in 1993, in 1995, at 27 years of age, James was promoted to Senior Manager, Underwriting and Distribution and was the youngest member on the Board of Senior Management at Middlesea Insurance plc (now https://www.middlesea.com/insurance-mt/ and part of the Grupo Mapfre). Middlesea plc was at the time going through an interesting juncture of its development having then recently shed its compulsory local reinsurance business and starting to grow more as a local insurer with the signing of new Maltese MGAs and tied intermediaries and with very strong stakeholders on board. Assicurazioni Generali SpA and Munich Reinsurance Company were shareholders in Middlesea at the time.

2002 – 2005

After a stint with the Bahrain Institute of Banking and Finance in Bahrain, Middle East, James returned to the Middlesea Group in Malta in 2002, heading the Malta International Training Centre as MITC’s first CEO (https://www.mitcentre.com/). MITC was then a Middlesea subsidiary, founded in 1981 and dedicated primarily to building a professional insurance cadre for the Maltese insurance market and embarking on training and development initiatives overseas. At that juncture, under James’ stewardship, MITC widened its menu of training areas and looked beyond local horizons, delivering training in insurance, risk management, compliance, regulation, securities and investments and financial services first in emerging central European countries and the Middle East and later in the Caribbean and West Africa.

MITC then represented several overseas accredited institutes including the Chartered Insurance Institute, the Institute of Risk Management, the Institute of Sales and Marketing Management, the Chartered Institute of Securities and Investment and the Chartered Institute of Arbitrators. It also delivered ACCA (accounting) training and was the local examination centre for all of these overseas institutes in addition to delivering actuarial classes. With over 50 professionally qualified visiting lecturers, MITC received students (locally or at their premises overseas) from over 60 countries and collaborated with overseas insurance regulators and associations as well as the Commonwealth Secretariat to promote professional insurance development globally.

MITC was later acquired by the Malta Financial Services Authority and in 2019 Deloitte purchased it and amalgamated MITC to the firm’s Human Capital Management stream.

2005 – 2015

From 2005 to 2015 James worked with a number of insurance undertakings in the Middle East, in senior executive management capacities, his longest stint being with Oman Insurance Company PSC (https://www.omaninsurance.ae/).

From 2005 to 2011, he occupied three senior executive management roles with Oman Insurance Company PSC, namely

- Executive Vice President, Distribution, being responsible for over € 100 million of annual, mainly general insurance, premium from a network of over 100 brokers and agents across the GCC. This also included involvement in significant outward facultative reinsurance design, negotiation and placements as well as field underwriting engagement on construction, property, business interruption and liability insurances for mega-projects in the region, including the Burj Khalifa construction project (Burj Dubai), airport and free-zone projects, towers, artificial islands and so on;

- Executive Vice President, Risk & Compliance, where James started the ERM function for the, then, largest GCC A-rated, UAE-publicly listed insurer. He worked very closely with rating agencies and actuaries, building company-wide ERM adoption and practice.

- Executive Vice President, Strategic Development, a role which entailed studying and implementing new strategic projects for the company.

Following significant upheaval in the company, James moved to Qatar for a short stint, working for a subsidiary of the Qatar Financial Centre (https://www.qfc.qa/en). Qatarlyst, acquired Ri3K, the UK insurance contract placement/fulfillment platform with the objective of rolling it out, first in the GCC and then internationally. Regrettably, it was a project before its time and the company was subsequently dissolved.

2011 – 2014

From 2011 to 2015 James worked first as an Executive Director for a regional insurance broker (https://lifecareinternational.com/) overseeing general and employee benefits insurance in UAE, Qatar and Kenya, and, later, as General Manager of a small, local general insurer in the UAE.

2015

On his return to Malta in early 2015, James joined Citadel Insurance plc (https://www.citadelplc.com/) heading the life assurance technical operations and general insurance distribution of Citadel, a local composite insurance company in Malta.

2016 to date

Refer “Board Appointments” above.