Demand Elasticity

Demand for a product tends to fall into three broad categories, i.e.

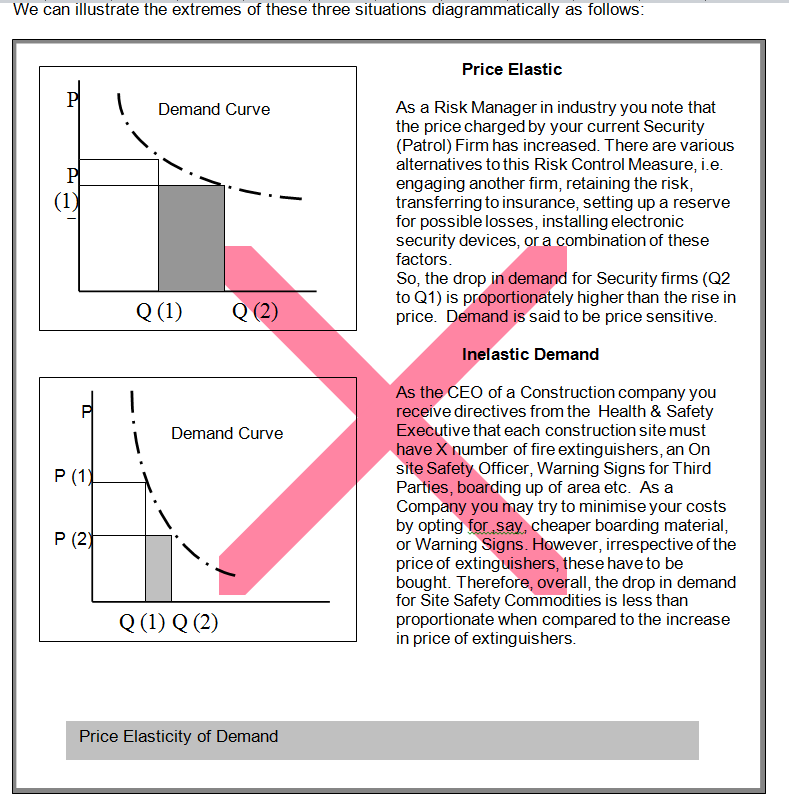

Highly price sensitive (Relatively elastic): This means that the change in demand is at a higher rate than the change in price.

Price Neutral: That the change in demand is equal to the change in price

Insensitive to Price Changes (Relatively Inelastic): This means that the change in demand for a commodity is less than proportionate to the change in price.

From the suppliers’ point of view, when demand is relatively elastic to price, a rise in price of his commodity results in a decline in overall demand for the commodity and also a drop in revenue generated from the commodity.

When the demand is relatively inelastic to price, then although overall demand falls, total revenue rises.

Self Assessment:

- Is demand for insurance in general price sensitive?

- Are there any insurance products where demand is relatively less price elastic than others?

Cross Elasticity

In the elasticity graphs above, we have mentioned the possibility of

- Either the Risk Manager opting for another Security Firm

- Or the Risk Manager opting for alternative means of controlling the Crime Risk.

When considering alternative means, the Risk Manager would be evaluating the cost of one measure against that of another. So, when the price of Security Firms in general goes up, then it is likely that the Risk Manager opts for a different means of control. These include retaining the risk out of operating expenditure, transferring it to insurance at a higher premium, or installing an electronic alarm system with remote monitoring etc.

The more competitive an industry is, the more sensitive consumers are going to be to price. Likewise, the greater the availability of substitutes the greater the sensitivity to price.

Cross elasticity also deals with the effect of changes in price/s of complements on the demand for a commodity. For example, an increase in taxation of on-shore reserve funds may increase the demand for alternative means of financial risk retention, such as offshore funds. Alternatively it may increase demand for financial risk transfer i.e. captive or conventional insurance, finite insurance, etc.

Elasticity of Supply

Earlier on we said that, all things being equal, suppliers want to supply more at a higher price and less at a lower price. In a broad sense, price is relative to the revenue generated and the profits reaped from a commodity. However, there are factors that affect the rate of change of supply when faced by changes in price.

The rate of change of supply primarily revolves on the issues of

- Ease of entry and/or exit into that market,

- Market distribution of commodity,

- Nature of commodity.

If an entrepreneur is in an industry where entry/exit is relatively difficult for example, it is unlikely that overall quantity supplied will decrease at a rate that is proportionate to a decrease in price. Ease of entry/exit is generally dictated by the investment required to enter the sector (typical examples are mineral extraction, oil refinery, aluminium processing etc.) The investment in that industry inhibits them from shifting to another industry sector. They may try to diversify the commodity that they offer – for example, an airline would shift from predominantly catering for business travel to tourist package deals – but the investment in aeroplanes prevents them from re-investing in another major tertiary activity, i.e. hotels. On the other hand, entrepreneurs in sectors with greater freedom of entry and/or exit would seek to diversify into other lines of business if prices for their current commodities fall.

Where an entrepreneur can diversify the market, goods are supplied for the markets that are willing to pay a higher price. A typical example of this is the property market in some of the offshore locations. In Guernsey, for example, there are two different property markets -one for the local community and another, which is primarily for expatriate residents. The price on local accommodation is protected for social reasons. That of the “Open Market” starts above a certain price bracket. Whereas there is a relative shortage in “local” accommodation, there is always a ready supply of “Open Market” property. Therefore, when market diversity is possible, supply can be sensitive to price increases in one market, or immune to price decreases in another market.

There are commodities that are of a generic nature. For example glass manufacturers can produce jars for the food industry or jars for pharmaceuticals. Admittedly, there may be some investment that may need to be incurred in the change, but this may not necessarily be prohibitive in itself. If the price in one industry falls, because of for example, competition, an entrepreneur may alter his commodity for sale in a different market sector that is less sensitive to price changes.

Self Assessment

- Does Elasticity of Supply apply to Insurance?

- Discuss this statement paying particular regard to ease of entry/exit into the market, market distribution of insurance as well as the nature of specific insurance products.

Different economic systems, the price mechanism and its effect on demand and supply, and the rate at which supply/demand respond to price changes are all an integral part of the economic environment in which a business operates. This environment, by its very nature, creates economic relationships (such as the direct relationship between scarcity and price). These relationships give rise to situations of risk and also, have a direct bearing on strategic decisions taken within companies. A lack of appreciation of how market forces operate may result in compounding the impact of technical losses on an enterprise.